Affiliate Disclosure: Automoblog and its partners may earn a commission if you purchase coverage from the extended warranty providers outlined here. These commissions come to us at no additional cost to you. Our research team has carefully vetted dozens of extended warranty providers. See our Privacy Policy to learn more.

- CarShield plans typically cost between $99 and $129 per month.

- We name the company as the provider with Affordable Monthly Payments in our industry study.

- CarShield has six coverage plans to choose from.

- All plans come with perks like 24/7 roadside assistance.

CarShield offers six extended warranty plans for drivers who want to protect their vehicles for the long haul. In our review team’s study of reputable extended car warranty companies, we rate CarShield as the provider with Affordable Monthly Payments. On average, CarShield vehicle protection plans cost between $99 and $129 per month. These competitive rates help keep the company near the top of the extended auto warranty industry.

One thing that sets CarShield apart from other extended warranty providers is the fact that it offers plans with unlimited terms. You can pay one monthly price for the life of your plan. This effectively means you can create your own warranty terms and your own payment plans while enjoying the added peace of mind that comes with protection from automotive mechanical breakdowns.

How Much Do CarShield Plans Cost?

We requested a quote from CarShield on Diamond coverage for a 2018 Toyota Camry with 28,000 miles on the odometer. The company offered a rate of $99.99 per month for 18 months, and this would provide five years or 100,000 miles of coverage. There was also a $295 down payment and each car repair came with a $100 deductible.

We also got a quote for Gold coverage on a 2013 Honda Accord with 90,000 miles. CarShield offered us an unlimited monthly payment plan of $119.99 each time, and this choice came standard with a $100 deductible.

CarShield prides itself on being one of the top-rated providers of extended vehicle warranties. CarShield offers a few different coverage plans to choose from. Its plans are affordable and comprehensive, making the company a great option for anyone looking for extended car warranty coverage.

While CarShield’s coverage levels are often referred to as extended warranties, they are technically vehicle service contracts. For more information about the provider’s coverage, check out our guide to CarShield plans.

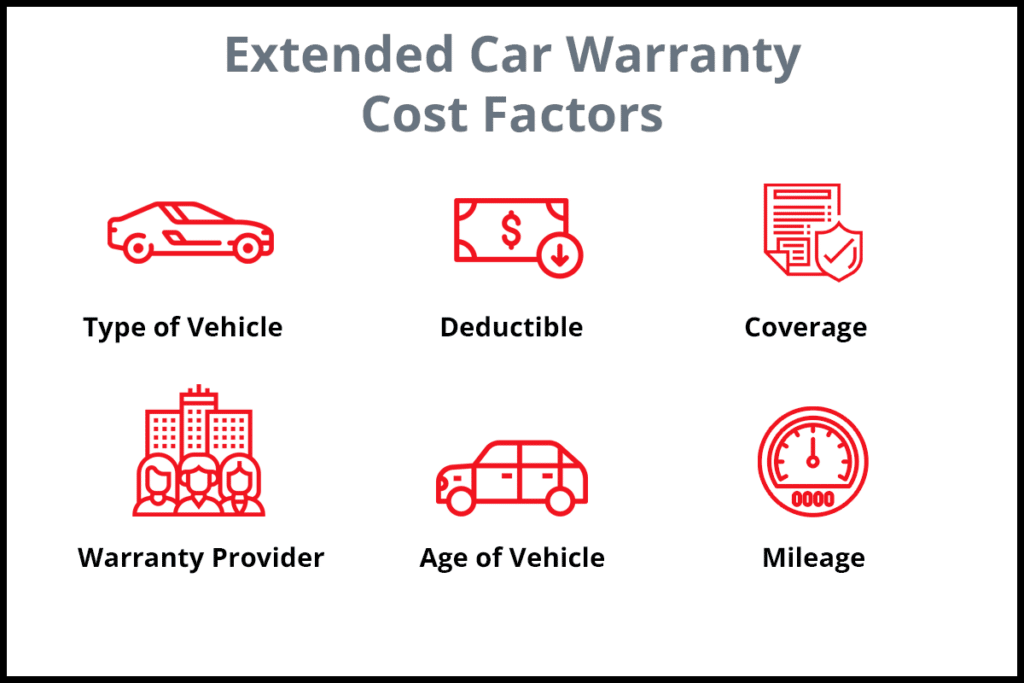

CarShield Warranty Cost Factors

Extended car warranty costs largely depend on your vehicle model, mileage, level of coverage, and chosen deductible. You can get a free quote through CarShield.com or by speaking with a CarShield customer service representative. Below is a further breakdown of how each factor affects your warranty costs:

- Mileage: Higher-mileage vehicles are more likely to suffer mechanical breakdowns and therefore tend to cost more to cover.

- Vehicle type: The pricier a car is and the more costly it will be to repair, the more a warranty provider will charge for coverage. Vehicles with reliability issues may also be charged higher prices for protection plans.

- Deductible: As with car insurance, many warranty companies allow you to set your own deductible – some all the way down to $0. But the lower you set your deductible, the more your warranty plan is likely to cost.

- Coverage plan: Of course, how much coverage you select is a major factor in pricing. The more comprehensive an extended warranty plan is, the more you’ll pay for it.

- Vehicle age: Like higher-mileage vehicles, older cars are more prone to breakdowns than newer ones. Therefore, most car warranty companies charge higher rates for coverage on older vehicles.

- Provider: Prices vary between the best extended car warranty companies, even for equal levels of coverage on the same vehicle. That’s why our team recommends getting quotes from multiple providers and comparing to see which one offers the lowest rates.

While CarShield is known for its competitive rates, the best way to find affordable coverage is by getting quotes from multiple providers. Compare the offer you get from CarShield to quotes from other reputable extended car warranty companies to make sure you get the best deal.

CarShield Coverage Plans

CarShield reviews speak highly of the company’s six levels of coverage. These range from basic drivetrain coverage to plans that compare to a new car’s factory warranty. The list below contains more info about these coverage options and their covered repairs:

- Diamond plan: The Diamond plan is CarShield’s highest level of coverage and is comparable to a manufacturer’s warranty or bumper-to-bumper coverage with only a few exclusions.

- Platinum plan: The Platinum plan covers most components from all major vehicle systems, but leaves out minor individual parts.

- Gold plan: The Gold plan fully takes care of the powertrain while adding on a few additional vehicle components, including power windows, the alternator and more parts.

- Silver plan: This is CarShield’s basic powertrain plan. It covers critical systems of your vehicle like the drive axle, transfer case, transmission, fuel pump and water pump, for the cheapest rate.

- Aluminum plan: The Aluminum plan covers electrical systems and computer-related problems including engine control module, starter, alternator, navigation/GPS, and more.

- Motorcycle & ATV plan: The Specialty plan is for nonstandard vehicle types such as motorcycles and ATVs.

CarShield Benefits

All CarShield plans include the following benefits:

- Roadside assistance

- Towing

- Fluid and fuel delivery

- Trip interruption coverage

- Rental car reimbursement

CarShield Quotes

The best way to determine what your CarShield plan might cost is to get a free quote from the company’s site, or by speaking with a customer service representative. Our team received a few quotes from CarShield, all for plans with a $100 deductible.

| Vehicle | Mileage | CarShield Plan | Term Length | Estimated Monthly Cost |

| 2017 Honda CR-V | N/A | Diamond | Unlimited | $129.99 |

| 2016 Chevrolet Silverado | 55,000 | Diamond | 5 years/100,000 miles | $129.99 |

| 2014 Ford Fusion | N/A | Platinum | Unlimited | $129.99 |

| 2017 Honda CR-V | 45,000 | Silver | Unlimited | $119.00 |

| 2013 Honda Accord | 90,000 | Gold | Unlimited | $119.99 |

| 2018 Toyota Camry | 28,000 | Diamond | 5 years/100,000 miles | $99.99 for 18 months |

CarShield Payment Options

CarShield allows you to pay month-to-month or buy a long-term plan. Each of these plans also require a down payment equal to the first month’s payment. In addition, CarShield offers four deductible options: $200, $100, $50, and $0. Remember that choosing a lower deductible will increase the overall cost of your plan.

Common Repair Estimates

By reviewing some car repair quotes, you can better determine if CarShield coverage is worth the investment. Courtesy of RepairPal, here are a few cost estimates for common repairs – that CarShield covers – of the vehicles listed above:

| Vehicle | Repair | Estimated Cost |

| 2018 Toyota Camry | Serpentine Belt Replacement | $94 to $114 |

| 2013 Honda Accord | Radiator Hose Replacement | $287 to $304 |

| 2016 Chevrolet Silverado | Power Seat Control Module Replacement | $598 to $635 |

| 2017 Honda CR-V | Oil Pump Replacement | $1,003 to $1,136 |

How Does CarShield Compare to Other Warranty Providers?

CarShield is a great option for drivers who want to stick to a monthly budget. That doesn’t mean it’s always the cheapest option for an extended car warranty. Those who decide to pay for a protection plan upfront may get the best price. It’s up to you to determine which cost factors are most important for you.

Our team sourced the following quotes for bumper-to-bumper warranty plans for a 2018 Toyota Camry with 28,000 miles. Each plan features a $100 deductible. The table below shows you how CarShield’s Diamond plan compares to other leading warranty providers.

| Warranty Provider | Plan | Term Length | Down Payment | Monthly Payment | Total Cost |

| CarShield | Diamond | 5 years/100,000 miles | $295.00 | $99.99 for 18 months | $2,094.82 |

| CARCHEX | Titanium | 5 years/100,000 miles | First month | $136.17 for 18 months | $2,451.06 |

| Endurance | Supreme | 5 years/100,000 miles | $455.65 | $71.59 for 36 months | $2,732.89 |

CarShield Cost: Is CarShield Worth Buying?

CarShield is often worth it for drivers who want one of the best extended warranty plans at a relatively reasonable rate. After researching the best extended auto warranty companies, our team named CarShield the provider with the best monthly payments in the industry. This is a good indicator that CarShield is worth it.

Additionally, CarShield reviews are generally positive. The company has an average rating of 4.3 out of 5.0 stars on Google with more than 14,000 CarShield customer reviews. While CarShield is not accredited by the Better Business Bureau (BBB), the company has a 4.0 out of 5.0-star rating on Trustpilot, based on over 40,000 reviews. While you can choose a robust CarShield extended warranty with comprehensive coverage, reviews mention that the company’s responsiveness during auto repairs isn’t always the best.

CarShield can be worth the investment for many drivers, even if it doesn’t pay out as much or more than one pays in. For many, the peace of mind of having coverage is a worthwhile investment on its own. CarShield is usually worth it for drivers looking for maximum peace of mind on the road. CarShield offers multiple levels of coverage that can suit the needs of nearly any driver.

CarShield Cost: FAQ

How much does CarShield cost on average?

CarShield plans typically cost between $99 and $129 per month. The price you pay will depend on your chosen level of coverage, deductible (there is typically a $100 deductible for each plan), and your vehicle make, model, age, and mileage. CarShield typically costs between $99 and $129 per month, though this number depends on your chosen contract, deductible amount, and plan length.

Is CarShield a good deal?

Yes, CarShield is usually a good deal compared to many extended warranty providers. The company is known for having some of the industry’s lowest rates. It also offers monthly contracts for added flexibility.

How much does CarShield cost per month?

Based on our research, the average cost of a CarShield Diamond plan for a late-2010s SUV with fewer than 50,000 miles is between $100 and $130 per month with a $100 deductible. A Gold plan for a 2013 sedan with just under 100,000 miles would also cost $130 per month with a $100 deductible.

Does CarShield have a deductible?

With CarShield, customers can choose the deductible – as low as $0 – with their plans. However, just like with car insurance, a lower deductible means a higher premium. Yes, most CarShield plans have a deductible of $100. The Diamond and Platinum plans have a deductible of $0. Yes, in most cases CarShield extended warranty plans have a deductible of $100. The company’s Platinum and Diamond level plans have a $0 deductible.

Where can you use a CarShield warranty?

You can use CarShield warranty coverage at any ASE-certified repair facility, as long as the work you need falls under your plan’s list of covered repairs.

Is CarShield a direct provider?

No. While CarShield sells vehicle protection plans, those plans are serviced by American Auto Shield.

Is CarShield available in California?

No. Like many extended warranty companies, CarShield does not offer coverage in the state of California. The state has strict laws about how extended warranty companies can operate.

Our Methodology

Our expert review team takes satisfaction in providing accurate and unbiased information. We identified the following rating categories based on consumer survey data and conducted extensive research to formulate rankings of the best extended auto warranty providers.

- Industry Standing: Our team considers Better Business Bureau (BBB) ratings, availability, and years in business when giving this score.

- Coverage: Because each consumer has unique needs, it’s essential that a car warranty company offers an array of coverage options. We take into account the number of plans offered by each provider, term limits, exclusions, and additional benefits.

- Affordability: A variety of factors influence cost, so it can be difficult to compare quotes between providers. Our team performs ongoing secret shopper analyses for different vehicles, mileages, warranty plans, and locations to give this rating.

- Transparency: We consider the transparency of each company’s contracts and the availability of a money-back guarantee when determining this score.

- Customer Service: Reputable extended car warranty companies operate with a certain degree of care for consumers. We take into account customer reviews, BBB complaints, and the responsiveness of the customer service team.