Affiliate Disclosure: Automoblog and its partners may earn a commission if you purchase a plan from the car insurance providers outlined here. These commissions come to us at no additional cost to you. Our research team has carefully vetted dozens of car insurance providers. See our Privacy Policy to learn more.

Before purchasing a truck, it’s smart to consider all aspects of ownership, including auto insurance rates. In this article, we’ll tell you everything you need to know about personal-use and commercial truck insurance, including average rates and how to compare multiple quotes.

To go ahead and find out how much truck insurance would cost for your vehicle, enter your zip code to get free quotes from top car insurance companies in your area.

How Much Does It Cost to Insure a Truck?

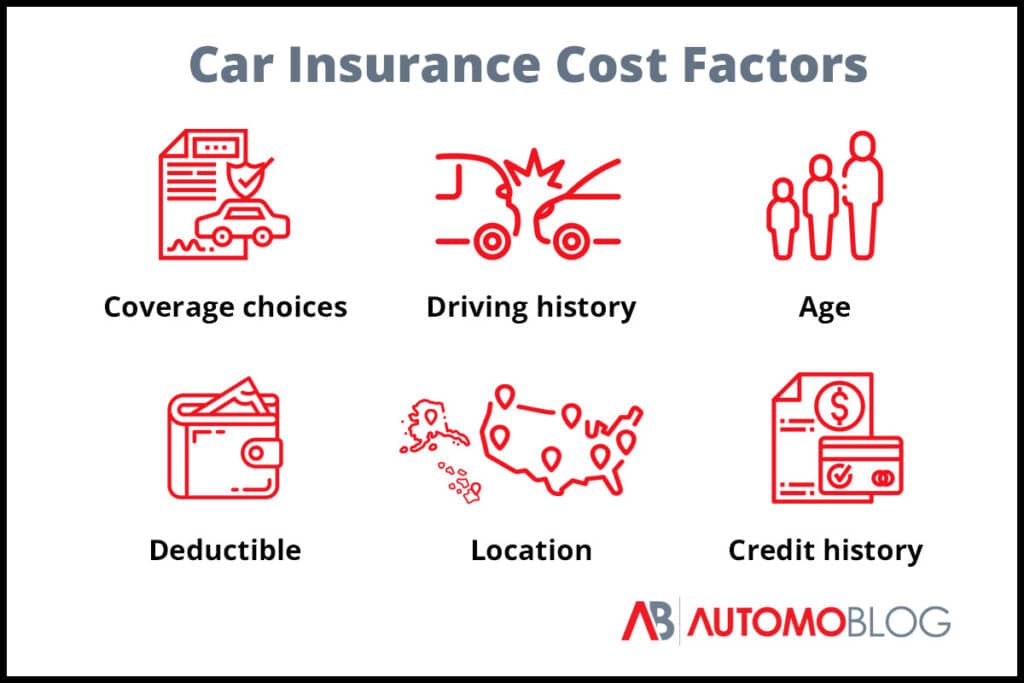

The cost of truck insurance varies depending on your vehicle, driving history, location and other factors.

When providing a quote for a pickup truck, insurance companies will consider its make, model, and year. They will also consider your age, credit score, and driving record. Any special modification, such as lift kits and other accessories, will also influence the cost of insurance.

If you are insuring a commercial truck, the total cost will depend on the type of truck, your area of operations, and what type of business you are conducting. For example, a flatbed truck that operates in a rural area will likely be cheaper to insure than a semi that hauls loads across the entire country.

Commercial Truck Insurance Statistics

As noted above, the type of business that you are conducting will be a major factor in determining the cost of your policy. The manner in which you conduct business will also be considered. Specifically, owner-operators without a permanent lease pay more for insurance coverage.

According to Progressive, the national average monthly cost to insure a commercial truck ranged from $640 to $982 in 2020. The lower figure was the average cost for specialty truckers like tow truck drivers. The higher amount was the average cost for transport truckers.

The East Insurance Group reported that owner-operators with a permanent lease paid roughly $3,000 to $5,000 per year for coverage. On the other hand, owner-operators that conducted business under their own authority paid anywhere from $9,000 to $12,000 annually. Costs have risen dramatically in recent years, causing new owner-operators to now pay as much as $16,000 per year for auto insurance.

Does Truck Insurance Cost More Than Standard Auto Insurance?

Insuring your pickup truck will not necessarily cost more to insure than a standard car. A high-end vehicle will likely have a higher premium than a standard pickup truck. However, commercial vehicles will cost significantly more to insure than personal vehicles.

Cost of Insuring a Pick-Up Truck

As mentioned above, there are a ton of factors that come into play when determining rates. The vehicle itself will make a huge impact on rates. For instance, an older, cheaper pickup truck will often cost less to insure than a brand new, loaded vehicle.

Your personal driving history and demographic information will also play a large role in determining the cost of coverage. Typically, male drivers between the ages of 16 and 25 years of age experience the highest rates. If you have a poor driving record and are in this high-risk bracket, you can expect your rates to be even more exorbitant.

Location is also another factor to consider. Drivers in rural areas often pay less for coverage because they are not around as much vehicle traffic. On the other hand, as drivers in metropolitan areas are statistically more likely to be involved in a crash, they will usually have higher rates.

What Is the Cheapest Pickup Truck to Insure?

If you are in the market for a new pickup truck, we want to help you make a wise purchase. With that in mind, we have compiled a list of 2019 to 2021 pickup trucks and placed them in order from the cheapest to most expensive to insure for most drivers:

- GMC Canyon SL

- Nissan Frontier S King Cab

- Ford Ranger

- Chevrolet Colorado Extended Cab

- Ford F-150 XL

- Ram 1500 Classic Laramie (2019)

- Ford F-250 Limited Diesel

- Ram 2500 Limited Diesel

- Ford F-350 Super Duty Limited

- Ford F-450 Super Duty King Ranch

The top five trucks on our list all cost less than $1,500 per year to insure. This figure represents the national average with full coverage auto insurance. The bottom five trucks on our list all cost at least $2,100 per year to insure. If you want to get that new pickup but want to keep your rates down, we would advise you to consider one of our top five picks.

When Do You Need Commercial Truck Insurance?

Commercial truck insurance is coverage that is specifically designed to protect the owners/operators of commercial vehicles. This includes tow trucks, garbage trucks, semis and even carrier vans. If a vehicle is designed specifically for business purposes, then it needs commercial truck insurance.

With that said, companies with three or more trucks will need commercial auto insurance for truck drivers. This type of coverage is often referred to as fleet insurance. It is important to make sure that you have the right coverage for your growing business.

Bottom Line: How Much is Truck Insurance?

At the end of the day, the cost of insuring your pickup will be comparable to the cost of insuring a car. However, insuring a commercial vehicle will be substantially more expensive.

Regardless of what type of truck you need to insure, it is essential that you choose the appropriate amount of coverage. Doing so will keep you and your property protected in the event of an accident.

Our Recommendations for Auto Insurance

Now that we have covered how much truck insurance can cost, it’s time to share our top picks for auto insurance coverage. During our industry-wide review of the top providers in the nation, we narrowed our search to a handful of reputable insurance companies. To start getting free quotes from insurers in your area, enter your zip code below.

GEICO: Most Discount Options

Our experts rated GEICO as one of the top insurance providers in the nation, awarding it a score of 4.4 out of 5.0. The overall score is a reflection of the company’s performance in our industry standing, availability, coverage, affordability, customer service, and online experience categories.

GEICO is known for providing excellent coverage at a great rate. The company has flexible policy options and a multitude of discounts. GEICO even offers rideshare and mechanical breakdown coverage. However, GEICO does not currently insure commercial trucks.

Progressive: Best for Accident-Prone Drivers

Our team awarded Progressive an overall rating of 4.5 out of 5.0. The company stands out, especially in our availability and online experience categories, scoring a 5.0 and 4.9 respectively.

Progressive offers plenty of discount options and flexible policies. Unlike GEICO, it also offers commercial truck insurance. The company has general liability and business owners’ policies so that you can cover every aspect of your company with a single policy.

How Much Is Truck Insurance?:FAQ

Do you need special auto insurance for lifted trucks?

Technically, you do not need special auto insurance just because your truck is lifted. However, your policy may not be enough to cover the cost of replacing aftermarket parts in the event of an accident.u003cbru003eWith that said, you should consider an aftermarket parts add-on to your existing coverage. This supplemental coverage is offered by many major providers, including Progressive and GEICO. Progressive calls its offering custom parts and equipment coverage.

When do you need commercial truck insurance?

You need commercial truck insurance if you own and are operating a vehicle for commercial purposes. For example, semi-trucks and flatbeds that are used for business purposes require commercial truck insurance.

What is the best auto insurance for trucks?

The best auto insurance for trucks is going to depend on a variety of factors, including the type of truck you own and your driving record. We recommend providers like GEICO and Progressive. Both topped our list of major car insurance providers in categories such as coverage, cost, customer service and industry reputation.