Nissan and Tesla are going in polar opposite directions.

The Japanese automaker, hoping to rebuild dwindling demand for its Leaf model, slashed the price for the all-electric model by as much as $5,845. That means a base version of the Nissan Leaf will cost just under $20,000 after federal incentives.

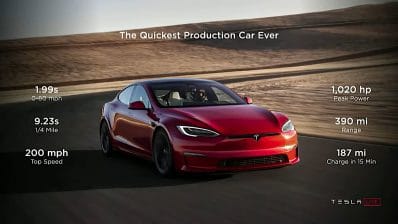

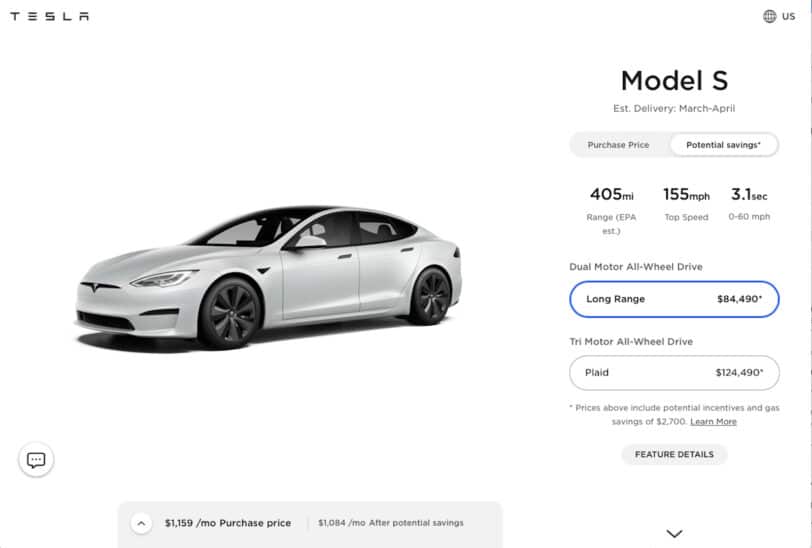

Tesla, which set an all-time record for deliveries during the second quarter of 2021, has begun raising prices pretty much across the board. And, with the latest jump, the new Model S Plaid sedan will now cost $10,000 more than it did barely a month ago.

Finding the sweet spot

Automakers are looking for the sweet spot when it comes to pricing their battery-electric vehicles. The challenge is to find a figure that reflects the actual cost of production while not reaching so high as to scare off potential buyers. That’s not easy considering that BEVs still cost substantially more to assemble than comparable vehicles using internal combustion engines — though costs have begun to tumble.

In Nissan’s case, it is struggling to keep demand going for the Leaf. It was the first mainstream BEV available in all 50 states when it launched a decade ago. Worldwide, the automaker has sold 500,000 of the battery cars, with more than 150,000 delivered in the U.S. But, as an array of alternatives have begun reaching the market, demand for the Leaf has plunged, American motorists purchasing just 7,729 of them during the first six months of the year.

So, Nissan is hoping to kick-start demand by reducing Leaf prices by anywhere from $4,245 to $5,845, depending upon model. At the same time, it announced, the 2022 models will get more standard features. All versions, including the base BEV, will now come with quick charger ports. On the high-end Leaf SV Plus model, tech features such as ProPilot Assist and Intelligent Around View Monitor, also will become standard.

First long(er) range EV at under $20,000

The entire range now starts with an MSRP of $27,400 for the Leaf S with a 149-mile range per charge. For a qualified buyer, after deducting federal tax credits of up to $7,500, that means the sticker price effectively would drop to just $19,900. (Of course motorists will still have to cover a $975 delivery fee, as well as taxes and fees.)

To bump range up to 226 miles, motorists would have to go with the Leaf S Plus, starting at $32,400 before incentives, taxes and fees. The top-range Leaf SL Plus, with a 215-mile range, will carry a $37,400 MSRP for 2022.

By comparison, the base 2022 Chevrolet Bolt EV starts at $31,000, while the Tesla Model 3 has jumped to $41,190.

Tesla bets on strong demand

Tesla, it seems, has taken a very different approach to pricing this year, a move that clearly reflects growing market demand. It delivered 201,250 vehicles during the second quarter of this year, breaking the previous record set just three months earlier, when deliveries came in at around 185,000 units.

The price of the Model 3, its most affordable model, jumped $500 in June. So did the Model Y SUV, which now starts at $53,190.

But that’s nothing compared to what Tesla has done with its top-line Model S and X. The base S sedan saw two consecutive price hikes during the course of barely one month, boosting the MSRP by a combined $10,000.

The increases came with the launch of the 2022 versions, Tesla partially justifying the move by pointing to design updates and added content. A check of the automaker’s configurator shows it will now cost $89,990 to get into a Model S. If you want the extreme performance version, the Model S Plaid, you’ll have to dig down for a starting price of $129,990.

EV prices need to fall

How these increases might impact Tesla sales remains to be seen, but industry data shows while the carmaker’s sales are up, its market share has slid sharply this year. Tesla is facing increasingly serious competition as more new offerings come to market, such as the Ford Mustang Mach-E, the Volkswagen ID.4 and the Chevy Bolt EUV. By the end of 2022, meanwhile, another dozen or more all-electric models will join the fray, from luxury sedans such as the Cadillac Lyriq to battery-powered pickups such as the GMC Hummer and Ford F-150 Lightning.

Demand for plug-based products doubled in the U.S. during the first half of 2021. Analysts are betting that price will play a significant role in pushing demand up sharply in the years to come.

The good news for automakers and auto buyers alike is that battery costs are tumbling — General Motors expects to see the figure drop from around $150 per kilowatt-hour to $100 as it gets production going at the new battery plants it’s setting up. Other costs, such as motor and electronic control systems, also are expected to dip due to economies of scale as volume grows.